Part 1:

Can your hospital survive the growing dominance of ASCs?

A Historic Challenge

U.S. hospitals are facing daunting headwinds. Traditionally at the center of healthcare, the American hospital is now confronting a variety of challenges that threaten to undercut its long-successful business model. One of the biggest of these challenges is a massive outmigration of surgery patients to specialized, highly efficient, patient-friendly ambulatory surgery centers (ASCs).

The migration of surgical volume to ASCs is a major strategic problem for hospital leaders. However, few executives have initiated an aggressive response, especially compared to their recent forays into the primary care market.

In recent years, hospitals have energetically pursued the primary care patient by employing a large percentage of primary care practices in the U.S. In contrast, hospitals have not demonstrated this kind of aggressiveness in the ambulatory surgery market. For the most part, the typical ASC remains independent of the hospital, being privately owned by surgeons or jointly owned by physicians and an ASC management firm.

This white paper will examine the ASC challenge from several angles. The goal is to help hospital executives answer a key question: Should our hospital develop and pursue a strategy of expansion into the ASC market?

The Shift to Outpatient Surgery

The first freestanding ASC was opened in 1970 in Phoenix. Fifty years later, there are now nearly 6,000 Medicarecertified ASCs in the U.S. These centers perform more than 23 million procedures annually, with total market revenue exceeding $36 billion. This steady growth, traditionally driven by advances in surgical and anesthesia science, is now accelerating under the payer-driven pursuit of better value in procedural care. The following is a closer look at the key trends.

Outpatient procedures now account for more than 80% of all surgeries.

Including both inpatient and outpatient surgeries, approximately 57 million procedures are performed in the U.S. every year.1 From a number of government sources, it is estimated that hospital inpatient surgeries (overnight admissions) account for less than 20% of these cases. Total annual surgery volume is now spread out among four categories:

- 23 million ASC procedures2

- 12 million office-based surgeries3

- 11.5 million hospital-based ambulatory surgeries

- 10 million hospital inpatient (overnight stay) surgeriesiii

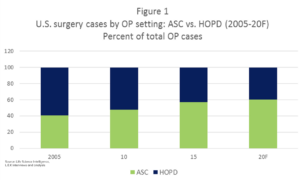

The outpatient surgery market has shifted dramatically.

The past 15 years have witnessed a significant outmigration of surgical volume from hospital outpatient surgery departments (HOPDs) to ASCs. During this time, the HOPD share of the total ambulatory surgery market has dropped from nearly 60% to just 40% (see chart at right).

This transition will continue for the foreseeable future.

Experts estimate that approximately half of the surgeries now performed in hospitals can be moved into ASCs.4 According to projections, the recent 4% annual growth5 in ASC volume will continue through most of the coming decade, and total ASC volume will increase 27% by 2027.6

Why this trend is so powerful — multiple independent drivers.

It cannot be emphasized too strongly that patients searching for value are a big factor in this industry transformation.7 In addition, private and government payers are now incentivizing both patients and surgeons to choose ASCs over hospital settings. The incentives include financial carrots for surgeons and lower ASC co-pays for patients. Simultaneously, ASCs are expanding into new specialties and procedures, including joint replacement, vascular surgery, cardiology and neurosurgery. Powered by these drivers, ASCs are expected to achieve $93 billion in yearly revenue by 2024.6

3 Market Forces Driving the ASC Ascendance

Traditionally U.S. hospitals have enjoyed yearly increases in both surgical volume and revenue. However, current surgical discharges have leveled off and are projected to decline 2% by 2022.8 This is a challenge to the fundamental economics of the hospital business, since approximately two-thirds of a typical U.S. hospital’s revenue and most of its profit come from procedural services — operating rooms, HOPD, Cath Lab, GI center, interventional radiology, etc.9 With the average hospital’s profitability now dropping to less than 1.5% (2017 data from Premier), the ongoing loss of surgical volume portends a bleak financial future for these institutions.

Drilling down, a range of market forces are having a significant adverse effect on hospital surgical volume:

Payer changes are erasing hospital advantages. Although hospitals have been experiencing a steady erosion of surgical volume to freestanding ASCs, they have managed to maintain revenue thanks to a built-in payment advantage. Traditionally, reimbursement for a hospital-based ambulatory procedure has been 92% higher than reimbursement for the same procedure performed in an ASC.10 Under this payment structure, the average facility fee for a simple lumbar spine fusion was $11,000 when performed in an HOPD, compared with $5,000 in an ASC setting.

Unfortunately for hospitals, payers are now actively challenging this traditional reimbursement disparity. On January 1, 2019 the Centers for Medicare & Medicaid Services (CMS) started implementing changes that removed “unnecessary and inefficient payment differences” between HOPDs and ASCs.11 These “site neutrality” measures are narrowing the gap between hospital and ASC reimbursement. CMS is also making changes designed to put ASC payment increases on the same footing as hospitals. Traditionally, ASC reimbursement has been tied to the consumer price index. As of 2018, ASCs payment rates are now linked to the same market basket that CMS uses to adjust hospital reimbursement.

+92% Average extra reimbursement for HOPDs vs. ASCs under traditional payment

In addition, Medicare co-pays are increasingly structured to promote patient use of ASCs. For example, the co-pay for cataract removal is $490 in an HOPD but only $193 in an ASC.1 CMS has also significantly expanded the approved ASC procedure list. Recent additions include a dozen cardiac catheterization procedures, various neurosurgical procedures and total knee arthroplasty. It should not come as a surprise that commercial payers are following the government’s lead with a variety of their own programs promoting ASCs over HOPDs.

Independent surgeons are taking surgical volume to ASCs. With few outside options, surgeons were once closely tied to hospital-based surgical services. With the rise of the ASC, this dedicated hospital affiliation has weakened to the degree that most hospitals have resorted to employing proceduralists in large numbers, in part to slow this outmigration of surgical volume. Although the number of independent surgeons and proceduralists is decreasing, these clinicians are increasingly avoiding the hospital OR and seeking the greater convenience, efficiency, quality and patient satisfaction available from the typical ASC. As ASC owners, they are also seeking the added income generated through gainsharing. This ASC partnership arrangement has been one of the fundamental drivers behind ASC success.

Increasingly, patients opt for ASCs whenever possible. It is a common lament of hospital leaders that ASCs are “cherry picking” their most desirable patients. For the most part, this is true. ASC patients are typically healthy (ASA I-III) and younger than the hospital surgical population. They are also more likely to be commercially insured, with private coverage rates ranging from 41% to 68%. In addition, with the growth of high-deductible health plans, more patients are seeking out ASCs with their lower out-of-pocket expenses.

Snapshot of the ASC Market

While the ASC market is in flux, high-level data provides a useful view of the industry:

- Geography. More than 90% of ASCs are located in urban areas. In rural areas, community hospitals continue to retain a large portion of the ambulatory surgery market.

- Ownership. Several large companies that specialize in ASC management control about 20% of all facilities, or about 1,500 ASCs. These companies either own the ASC jointly with proceduralists or, usually in larger multi-specialty facilities, manage operations without an ownership stake.

- Specialty mix. About 60% of ASCs are single-specialty facilities, with gastroenterology and ophthalmology centers being the most common. However, multi-specialty ASCs are currently growing at a much faster rate and command a larger share of total market revenue.

ASCs currently enjoy several unique advantages this healthcare market:

Increasing reimbursement. As stated above, CMS is acting to shrink the reimbursement disparity between ASCs and HOPDs. One strategy is simply increasing ASC payment rates. In 2019, ASCs received a 2.1% increase in CMS payment versus a 1.35% increase for HOPDs.

Gain-sharing opportunities. The Stark Law permits profit-sharing among owners of an ASC. Accordingly, 94% of ASCs are for-profit (CMS data). Interestingly, this gain-sharing “safe harbor” is open to both surgeon-owned ASCs and hospital/physician joint-venture ASCs.

Robust quality. ASCs have long had a reputation for both quality and efficiency among surgeons, and recent efforts to introduce public reporting should underscore this ASC advantage. The government now requires all CMS-certified ASCs to track quality metrics. Additionally, The Leapfrog Group is now collecting safety data from ASCs and HOPDs through a new voluntary survey.12

Despite the many advantages that ASCs enjoy, it’s not all smooth sailing. Evolving market conditions are creating new hurdles for ASCs and accentuating old challenges.

Tightening margins. Reimbursement rates for ASCs, similar to hospital rates, are being squeezed by payers. At the same time, ASCs are facing increases in personnel costs, technology, and supplies expenses. Careful management of operations, productivity and material costs are essential for continued success.

New competition. In the same way that hospitals are losing procedure volume to ASCs, the ASC industry is also contending with a new market challenger — office-based surgery (OBS). Many simple procedures can now be performed safely in a physician office setting. Gynecology, ENT, ophthalmology and plastic surgical specialties are leading the increase in OBS volume.13

Saturation in select markets. Although the ASC industry is still expanding in procedure volume and facility count, overall growth has slowed noticeably. This is an indication that ASCs are nearing saturation in a significant number of markets.

Political obstacles. Over half of the states require a certificate of need (CON) before opening an ASC. Obtaining a CON can be difficult, especially when potential competitors — hospitals, other ASCs and ASC management companies — are influencing this decision. As expected, CON states have lower penetration of ASCs compared with non-CON states.

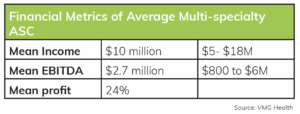

Why an ASC is different from a hospital OR

Hospital executives who are contemplating a strategic expansion need to understand the operational and clinical factors that make ASCs very different from the hospital OR. In 2017 VMG Health published a comprehensive review of 278 multi-specialty ASCs with a combined surgical volume of 1.3 million procedures.14 According to the review, the “average” ASC has 4 operating rooms and 2 procedure rooms and performs about 5,000 cases per year. The financial results are impressive (see below).

These results are driven in part by a favorable payer mix. For ASCs in the study, commercial insurance paid for 53% of all cases and represented 64% of total facility revenue. However, the financial success of these facilities also owes a great deal to the unique ASC operating environment:

Efficient operations. Based on data from Surgical Directions, high-functioning ASCs typically have a case cancellation rate of less than 1%. In addition, their turnover times are approximately one-half to one-third of the turnover time for similar cases in a hospital.

Efficient operations. Based on data from Surgical Directions, high-functioning ASCs typically have a case cancellation rate of less than 1%. In addition, their turnover times are approximately one-half to one-third of the turnover time for similar cases in a hospital.

Lean labor costs. According to the VMG review, the average ASC has 31 total staff, with 15 RNs, 7 techs and 9 administrative personnel. This contributes to a lean expense structure, with the cost of elective operating room time at less than $15 per minute in an ASC versus $40 a minute in a hospital OR.

Optimal productivity. Based on the annual case volume numbers cited above, the average ASC performs 1,200 cases per OR and 1,650 cases per procedure room every year. In comparison, average hospital OR productivity is less than 1,000 cases per year.15 One factor is that ASC productivity is typically driven by a core group of surgeon owners. In the average ASC, less than 10 physicians perform 73% of procedures (VMG data). In fact, most high-volume ASC proceduralists are owners who have a personal stake in running a highly efficient facility. In summary, the mainstream ASC is relatively small compared with the typical hospital OR. It is both highly efficient and very productive, performing 50% greater volume per room compared with the hospital. In both single and multispecialty ASCs, a small number of surgeons/proceduralists perform the majority of cases. The facility’s high productivity is linked to a more collaborative culture characterized by close cooperation among surgeons, anesthesia, nursing and administrative staff. All this adds up to profit margins that can exceed 40% and very high patient and surgeon satisfaction.

ASC Expansion – What stands in the way?

Payers, physicians and patients are leading the transition of procedural services to the ambulatory environment. Of course, this has not gone unnoticed by hospitals and health systems. But despite the fact that most hospital leaders understand the many advantages of the ASC model, relatively few have moved strategically on this insight. Expansion opportunities do exist. Only about 20% of ASCs have hospital ownership. At the same time, 60% of existing ASCs remain unaffiliated and privately held by physician owners — in spite of the fact that the major ASC management firms, investment banking firms and even health plans (for example, OptumCare’s 2017 purchase of Surgical Care Affiliates) are aggressively moving into the outpatient surgery market. What has kept the majority of hospitals and health systems from pursuing a more focused strategy of entering into this ASC market?

There are several reasons:

- A tradition of wariness.

- Different surgery cultures.

- Difficulty agreeing on a revenue split.

- Hospital payment advantage.

- Forest vs. Trees.

A tradition of wariness. Hospitals and physicians have kept each other at arm’s length for nearly a century. Physicians are only loosely affiliated with their primary hospital, and this connection is typically mediated through either a medical staff structure (private hospitals) or a faculty practice plan (academic medical centers). Hospitals and physicians each have their agendas, often very different and sometimes contentious. The current trend of physician employment has had only a marginal effect on the entrenched wariness between hospitals and their physicians, especially surgeons (Surgical Directions observation).

Different surgery cultures. This problematic relationship extends into the hospital’s operating rooms. Compared with ASCs, hospital-based procedural services are less surgeon- and patient-friendly. Surgeons often have problems accessing the OR schedule, and OR productivity and efficiency are typically lower than ASC performance levels. These issues make surgeons wary of partnering with the hospital to develop an ambulatory center. Given a choice, surgeons usually prefer teaming up with an experienced management company or, even more preferable, going it alone.

Difficulty agreeing on a revenue split. Hospitals and physicians in the U.S. have traditionally been reimbursed through separate fee-for-service systems. Revenue sharing (or gainsharing) between hospitals and physicians has been actively shunned by both parties. (Even splitting revenue among physicians can be difficult.) Gainsharing arrangements between hospitals and surgeons have often been characterized by contentious and difficult negotiations. It is not uncommon for these negotiations to end unsuccessfully, without agreement on management structures or gainsharing portions.

Hospital payment advantage. As discussed above, the HOPD reimbursement advantage has kept hospitals profitable even as surgical volume has leaked to ASCs. As a result, there has been little need to share revenue with surgeons. Only relatively recently, with dropping HOPD revenue and increasing costs, have hospital leaders been compelled to look at other sources of revenue and diversification.

Forest vs. Trees. The current fiscal woes of the typical U.S. hospital are keeping executives and board members focused on day-to-day operations. Longer-range strategic planning — including expansion into the ASC market — is usually very low on the priority list

ASC Strategy Matrix: 4 Options for Hospitals

Hospitals have four potential options when considering an ASC strategy. Each option has advantages and disadvantages:

Option #1: Avoid ASC expansion and concentrate on improving HOPD services. This option is appealing to many hospital leaders, but for most it is unworkable. As noted above, payers are rapidly erasing the hospital reimbursement advantage, so purely financial incentives for maintaining the traditional HOPD model are shrinking. In addition, at this time regulations do not permit gainsharing in the hospital HOPD setting, so any effort to energize an HOPD will not be able to rely on financially aligned surgeons. Perhaps most important, the lower efficiency of the typical hospital OR is due in part to entrenched cultural realities. Any effort to transform a HOPD will have to overcome strong internal resistance. One possible exception: It should be noted that rural hospitals usually face a less competitive ambulatory surgery market. In this case, expanding and improving HOPD services may by a viable option.

Option #2: Convert an HOPD into an ASC. Many hospital leaders understand the changing dynamics of the outpatient surgery market but are reluctant to fully abandon the hospital-centric model. Some of these executives are attracted to the possibility of converting an existing HOPD into a joint venture an ASC.16 If a gainsharing model is part of this ASC transition, a careful choice of surgeon-owners and specialties is indicated. Although net reimbursement is reduced, transitioning to an ASC gainsharing model can ensure continued surgical volume and surgeon commitment. However, a successful transition must include operational and cultural improvements that are found in a “typical” ASC.

Option #3: Build a new freestanding ASC. Assuming CON issues have been addressed and market research confirms an opportunity, building a freestanding ASC can have cost advantages over purchasing an existing ASC. This is true whether leasing space or building de novo. For example, the cost to build an average 4-room ASC is between $5 million and $10 million. In comparison, an existing ASC with the same number of rooms and a yearly EBITDA of $3 million would cost at least $20 million to purchase. In addition, the “building new” option enables a hospital to carefully select its surgeon partners, avoiding issues with less desirable specialties or less productive clinicians. However, a brand-new ASC can have a significant startup period, with a challenging operational learning curve and up to three years before reaching full procedure volume. One overall caution: This option should be avoided in a saturated ASC market.

Option #4: Purchase an existing ASC. The main advantage of purchasing an existing ASC is that it is a known entity. Volume patterns and operational processes are well established, which removes a good deal of risk from the transaction. However, as noted above, an efficient and profitable ASC can be costly, with a purchase price that is typically 6 to 7 times EBITDA. Hospitals considering an ASC purchase should move with caution.

- First, it is important to remember that not all ASCs are profitable or provide consistently high-quality patient care. According to the most recent CMS data on ambulatory surgery enterprises, for every two ASCs beginning operations, one closes its doors.

- Second, ASC management companies and investment firms have a significant presence and expertise in this market. Competing against these experienced companies for existing ASCs can be challenging. Additionally, the market for existing ASCs is tight — on average, only 2% of existing ASCs are sold yearly.

- Third, most ASCs have a limited life expectancy. Under a gain-sharing model, the share price in a successful ASC rises steeply with increasing EBITDA. This benefits surgeon owners, but effectively eliminates the possibility of adding new surgeon partners through additional share allocation. As its owners age, the ASC eventually reaches a time for either re-syndication or closure. Beware of an ASC seeking a hospital buyout with a high asking price. A careful review of financial and operational performance is indicated in any ASC purchase.

Stay Focused and Move Forward

With hospital outpatient surgical volume continuing to decline, hospital survival will ultimately depend on a strategic plan that includes both hospital and ambulatory-based procedural care. While most hospitals have a range of options for moving forward, leadership teams need to maintain steady focus on the basic market realities. Hospital executives and boards should keep three ideas front of mind:

Continued advances in procedural science and the ongoing search for value will likely leave the average urban hospital with only complex surgical care. HOPD ambulatory care will continue to decline, being replaced by ASC and OBS providers.

Besides employing surgeons, hospitals will have to consider other options for improving surgeon loyalty and productivity. This will likely include building a gain-sharing relationship with surgeons and proceduralists, both within the hospital and in hospital-owned ASCs.

Compared with what hospital leaders are used to, working with ASC physician-partners (both employed and independent) will require a very different collaborative leadership and management style. A patient-centric, value-focused system with aligned incentives is at the heart of ASC market dominance.

Hospitals that choose to pursue ASC expansion will need to master several new competencies. While there are several components of a successful ASC strategy, six key imperatives are essential to a strong start:

- Careful market research is a must. Ensure the local market can support ASC expansion or HOPD transition.

- Choose a strong specialty focus. The most successful ASCs are typically built on a relatively limited number of high-margin specialties, such as orthopedics, spine surgery, ENT, pain, etc.

- Select partners carefully. When purchasing an existing ASC, a re-syndication of surgeon shares may be indicated. This enables the hospital to select and partner with the right specialties and surgeons, which is essential for building volume and ensuring future success.

- Commit to gain-sharing. Most successful ASC strategies include profit sharing with surgeons. The added financial incentive helps to ensure adequate volume and active surgeon participation in facility management. The best way to develop experience in this area is to pilot gain-sharing arrangements with hospital-employed surgeons and proceduralists.

- Do not insist on the lion’s share. Hospitals should not expect more than a 51% ownership stake in an ASC. In fact, most hospitals are now entering the ASC market as a minority shareholder with less than 50% ownership.

- Focus relentlessly on operations. Any ASC expansion strategy will require hospitals to adapt to a new environment. Leadership teams will need to set aside many familiar concepts and collaborate with surgeons to create a face-paced organization that delivers high-value procedural care. The key is to focus relentlessly on operational efficiency. For a complete discussion of ASC operations, management structures and clinical optimization strategies, download the second white paper in this series: The Hospital Executive’s Guide to ASC Expansion Strategy Part II: Building and Managing a High-Value ASC Operation

Resources

1. Bill Frack, Jeff Williamson and Kevin Grabenstatter. Ambulatory Surgery Centers: Becoming Big Business. L.E.K. Consulting Executive Insights, Volume XIX, Issue 25. April 17, 2017.

2. A variety of sources, including VMG Health, Becker’s Hospital Review and Surgical Directions internal analysis.

3. Fred E. Shapiro et al. Office-Based Anesthesia: Safety and Outcomes. Anesthesia & Analgesia, 119(2), 276-285, 2014.

4. Robin Richards. Top Outpatient Surgery Center Trends in Health Care. Optum Health Care Conversation. February 5, 2019.

5. Future Market Insights. Ambulatory Surgical Centers Market: Global Industry Analysis 2012-2016 and Opportunity Assessment 2017-2027. September 27, 2017.

6. The Advisory Board. The New Rules of Ambulatory Surgery Center Competition; Three Steps to Build a Winning ASC Strategy. January 17, 2019.

7. Research and Markets. 2018 Ambulatory Surgery Center (ASC) Market: Projected to Increase from $36 Billion in 2018, to $40 Billion by 2020. Business Wire. October 11, 2018.

8. Sg2. 2017 Impact of Change Forecast: Finding Growth. May 5, 2017.

9. Surgical Directions internal data.

10. MedPAC. Report to the Congress: Medicare Payment Policy, Chapter 5: “Ambulatory Surgical Center Services.” March 2018.

11. Centers for Medicare & Medicaid Services. CMS Finalizes Medicare Hospital Outpatient Prospective Payment System and Ambulatory Surgical Center Payment System Changes for 2019 (CMS-1695-FC). November 2, 2018.

12. The Leapfrog Group. The Leapfrog Group Expands Ratings to Outpatient and Ambulatory Surgery Settings. October 16, 2018. 13. T

13. Blasco and S. Meisner. Modern Anesthesia, Office Based Anesthesia, Strategic Marketing Plan, July 2016. Mednax internal document. Supporting portions available upon request from Surgical Directions.

14. VMG Health. 2017 Intellimarker Multi-Specialty ASC Benchmarking Study. January 11, 2018.

15. Surgical Directions internal data.

16. Key Trends in Ambulatory Strategy: When an HOPD to ASC Conversion Makes Sense. Panel discussion at Becker’s Hospital Review 9th Annual Meeting (Chicago). April 11, 2018.

i. National health Statistics Reports; Ambulatory Surgery Data from hospitals and ASCs: US 2010, Number 102, Feb 28th, 2017

ii. Advancing Surgical Care, ASCs: A Postive Trend in Health Care, ASCA Home, 2012