Piedmont’s Journey to Improved Anesthesia Coverage and OR Access

Executive Summary

Problem: Large multi-site system (17 acute hospitals) relied on nine anesthesia provider groups (employee groups, community groups, national/private equity vendors), which produced variable performance, escalated costs, and created material risk to surgical access.

Solution: A two-year partnership with Surgical Directions resulted in key hospitals being analyzed. The outcome included an inventory and gap analysis, vendor/revenue cycle partner consolidation, standardized compensation and coverage models, retention incentive implementation (including restrictive-covenant payouts and a 1099 locum option), and a phased execution of employment transition when appropriate.

Results: High stability and rapid operational traction

- 98% of transitioned providers were retained

- Consolidated revenue cycle vendor that produced “dramatic” improvement in collections

- Reduced reliance on costly locums

- Expanded employed footprint with additional hospitals scheduled for onboarding

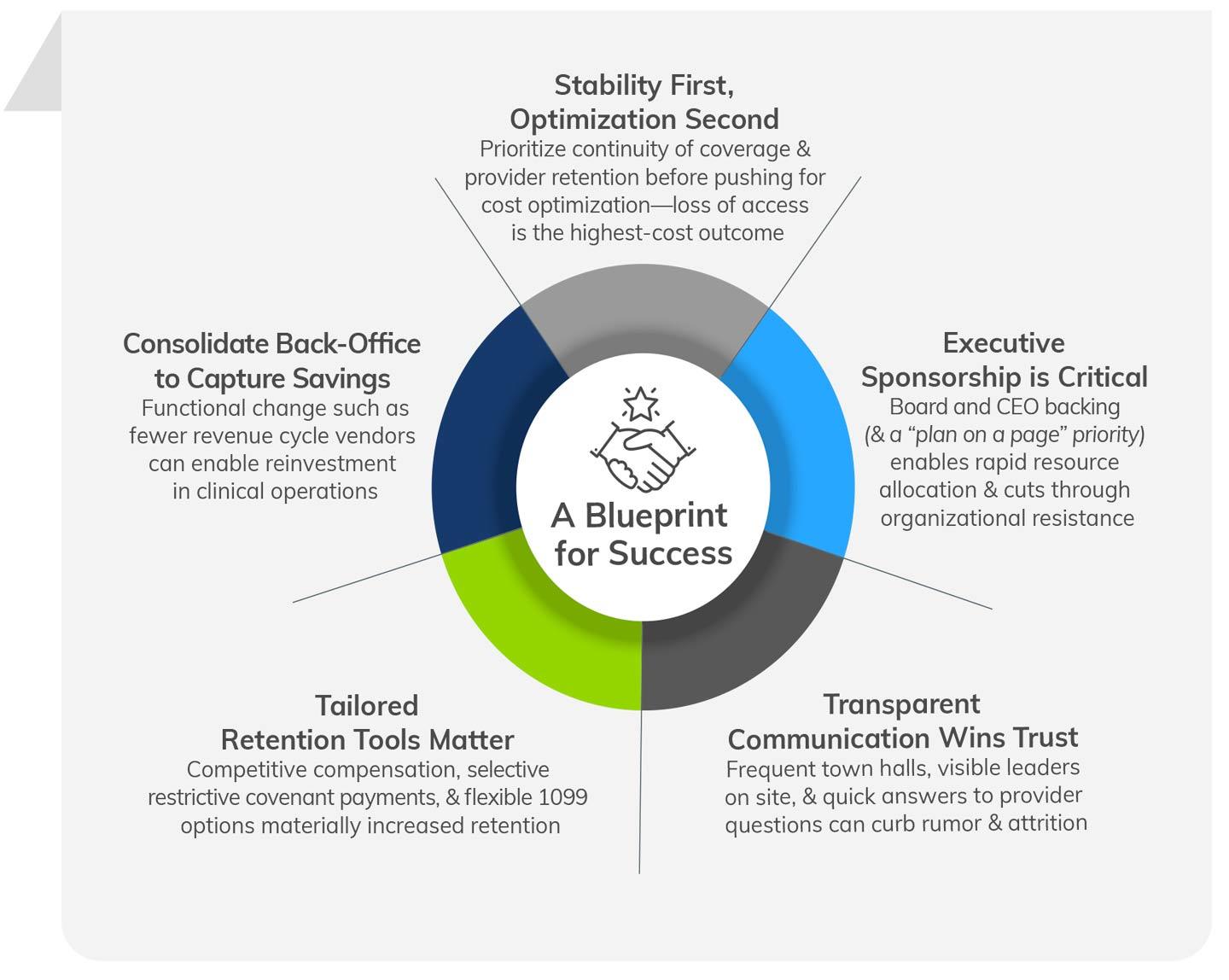

Strategic value: The program prioritized constancy first (protecting procedural revenue and patient safety), then operational optimization and growth — shifting control back to the system and reducing downstream disruption risk.

PROBLEM

Piedmont faced a multi-layered anesthesia services challenge that threatened surgical access, quality, and margin:

- Fragmented provider ecosystem: Seventeen acute hospitals were supported by nine different anesthesia provider arrangements, ranging from in-house employee groups to private equity-backed national vendors. This fragmentation created inconsistent clinical practice, variable contractual terms, and uneven service delivery across the system.

- Escalating & opaque costs: Vendor-backed groups had growing stipend/contract demands and uneven performance; the system lacked a single picture of where dollars were being spent and whether they were buying commensurate value.

- Operational interdependence: Anesthesiology’s poor performance was tightly coupled to operating room (OR) throughput and overall procedural revenue. Increasing costs also added additional pressure.

- Risk of service disruption: Contract instability and the potential for vendor non-renewals or termination posed a real threat (e.g., forced OR reductions or closures) to hospital surgical capacity and safety.

- Variable back-office performance: Anesthesia revenue cycle functions were fragmented across multiple vendors, producing suboptimal collections and unstandardized measurement.

- Workforce market realities: Recruitment and retention pressures for anesthesia clinicians made continuity fragile, requiring a strategy for stability and growth.

SOLUTIONS

Piedmont and Surgical Directions implemented a phased, multi-pronged approach that balanced immediate mitigation with long-term capability building.

Phase 1 — Diagnostic & Rapid Mitigations

- Comprehensive inventory & gap analysis: System-wide assessment was conducted for contracts, coverage models, locums spend, revenue cycle flows, and clinical performance by hospital and service line.

- Vendor & contract review: Identified underperforming vendor relationships and modeled alternatives (replacement vendors, employment, MSO/managed services partners).

- Revenue cycle consolidation: Reduced the number of anesthesia revenue cycle vendors from three to two, capturing scaled benefits and improved collections.

- In-house 1099 locums pathway: Developed an internal program to keep providers engaged with Piedmont through flexible work, reducing reliance on third-party locum agencies.

- Retention economics: Negotiated and paid restrictive covenant/retention packages where necessary to secure continuity of care, preserve institutional knowledge, and maintain a high-quality group of providers.

Phase 2 — Stabilize, Standardize, & Scale

- Transition to employment (phased): Executed a May 1 employment transition for select sites, with standardized Piedmont payroll, compensation models, and career opportunities.

- Standardized clinical & operational processes: Aligned practice scope (AA/CRNA roles, staffing ratios), scheduling conventions, and call expectations across employed sites to reduce variability.

- Leadership & governance: At the selected sites, we installed dedicated anesthesiology leadership and established executive-level sponsorship to ensure resources, rapid decision-making, and transparency.

- Communication & transparency agenda: At the chosen sites, town halls were implemented along with weekly updates, leader visibility tours, direct leader-to-provider lines (via email and text), and active management of the small cohort of skeptics to reduce rumor and turnover risk.

- Recruitment & mobility proposition: Packaged system career pathways across complex hospitals, community hospitals, and ASCs, enabling internal mobility and building a robust recruitment proposition.

RESULTS

Retention & Workforce Stability

- 98% retention of providers through the transition — a core success metric cited by leadership (achieving near-complete continuity despite industry churn). This dramatically reduced immediate replacement and locum costs and preserved institutional safety and relationships with surgeons.

Operational & Financial Performance

- Revenue cycle improvement reported as “dramatic” after vendor consolidation (fewer vendors resulted in more consistent billing and collections). Piedmont leadership characterized the collections impact as material to offset the transition costs.

- Reduced locums dependency showcased through early evidence of contract providers converting to W-2 employment or to the system’s 1099 locums program; leadership reported growing momentum toward in-system coverage and reduced premium pay exposure.

- Scalable employment footprint. Following the May 1 go-live, Piedmont planned additional hospital onboarding on November 1 with two more hospitals lined up — indicating operational playbook maturity and the ability to scale.

Quality, Safety, & Trust

- Avoided clinical risk: Retaining the incumbent, high-performing anesthesia workforce mitigated the safety risk of bringing in large numbers of unfamiliar locum staff.

- Improved direct communication: Creating synergy between system leaders and frontline providers eliminated middleman friction points, with providers reporting greater clarity and responsiveness.

Strategic Outcomes

- Market perception & partnering interest: Local groups and smaller vendors began approaching Piedmont, interested in joining the system to stabilize under Piedmont’s model rather than selling to national private equity firms. This creates greater options for growth and consolidation capacity.

- Culture & recruitment advantage: A clear career pathway and visible leadership engagement enhanced the platform’s attractiveness for recruitment and retention.

Transition Checklist

- Begin with a rigorous inventory of contracts, locum spend, clinical performance, and revenue cycle performance by site.

- Model scenarios for employment, joint ventures, and MSO partnerships, including realistic locum replacement and patient safety impacts.

- Build a retention playbook (restrictive covenant, sign-on, and 1099 options) and an aggressive communications plan for providers.

- Consolidate revenue cycle and analytics early to ensure you can measure, manage, and fund transition costs.

- Secure top-level sponsorship before making public commitments — system alignment materially increases chances of success.

- Phase the transition (pilot → standardize → scale) to preserve momentum while managing risk.

Conclusion:

Piedmont’s focused, strategic transformation proved that prioritizing stability and provider engagement lays the foundation for sustainable growth, operational excellence, and improved financial outcomes. This comprehensive approach has not only rejuvenated anesthesiology services at scale but also positioned the system for ongoing innovation and excellence in patient care.